In early February 2024, G&E Sales together with Construct Green had the privilege of participating in a German Emirati Joint Council for Industry & Commerce (AHK) business delegation trip to the Kingdom of Saudi Arabia, organized in cooperation with GESALO (Delegation der Deutschen Wirtschaft für Saudi-Arabien, Bahrain und Jemen).

Saudi Arabia's Construction Boom: A Market Overview

Saudi Arabia's construction market is experiencing unprecedented growth. The market is expected to reach $78.60 billion in 2025 and to grow at 4.51% annually to reach $98.01 billion by 2030, driven by the ambitious Vision 2030 program.

Key Market Drivers: The scale of investment is staggering. Saudi Arabia has launched $1.3 trillion in real estate and infrastructure projects over the past eight years as part of its economic diversification plan. Construction spending hit a peak of $260 billion in 2025, with over $500 billion invested in NEOM alone, $40 billion in Qiddiya, and $60 billion in Diriyah.

Vision 2030 Progress: The transformation is delivering results. With 85 percent of initiatives completed or on track and 93 percent of key performance indicators achieved or nearing completion, Saudi Arabia has built a strong foundation for a future beyond oil. The private sector now contributes 47% to GDP, unemployment dropped to 7%, and female labor force participation reached 33.5%.

Why G&E Sales Joined This Business Delegation

For G&E Sales and our partner company Construct Green, this trip represented a strategic opportunity to understand the Saudi market firsthand. The Kingdom's focus on sustainable construction and renewable energy aligns perfectly with our expertise and offerings.

Our Mission Objectives:

Market Assessment: Understand the demand for sustainable construction solutions and renewable energy technologies in Saudi Arabia's megaprojects.

Partnership Development: Connect with local companies, government entities, and project developers who could benefit from green construction solutions.

Regulatory Understanding: Learn about the business environment, localization requirements, and investment regulations affecting foreign companies.

Project Pipeline Visibility: Identify specific opportunities within the massive infrastructure and construction pipeline.

Day One: Riyadh - The Heart of Vision 2030

Our first day in Riyadh began at the GESALO office, where we received a comprehensive briefing on the current market landscape.

Qiddiya: Entertainment Meets Innovation

Our first site visit took us to Qiddiya, one of the Public Investment Fund's flagship megaprojects. This $40 billion entertainment, sports, and culture hub is being built southwest of Riyadh and will feature a Six Flags theme park, sports facilities, and entertainment venues. Seeing the scale of development firsthand was impressive - this isn't just construction, it's creating an entirely new industry sector for Saudi Arabia.

Red Sea Global: Redefining Luxury Tourism

Next, we visited Red Sea Global, a $23.6 billion sustainability-focused luxury tourism project along Saudi Arabia's Red Sea coast. What stood out was their commitment to environmental protection and sustainable development - they're setting new standards for eco-tourism. For Construct Green, projects like this demonstrate the Kingdom's serious commitment to sustainable building practices.

Riyadh Airports: The Future Logistics Hub

At Riyadh Airports, we met with Christopher Strand, General Manager of Aerodrome, who briefed us on the development of Riyadh Airport as a new logistics hub. The King Salman International Airport project is transforming the capital's connectivity and will be crucial for the Expo 2030 Riyadh, which expects to welcome over 40 million visits and will be accessible from the airport in just 10 minutes via the metro system.

Day Two: Jeddah - Gateway to the Red Sea

Our second day began with a breakfast briefing with H.E. Michael Kindsgrab, German Ambassador to Saudi Arabia. His insights into German-Saudi business relations and the opportunities for German companies were invaluable.

Jeddah Airports (JEDCO): Expanding Capacity

At Jeddah Airports headquarters, we learned about expansion plans for King Abdulaziz International Airport, one of the busiest airports in the Middle East. With tourism expected to reach 150 million visitors annually by 2030, airport infrastructure is critical to Saudi Arabia's tourism ambitions.

Jeddah Chamber: Understanding Local Business

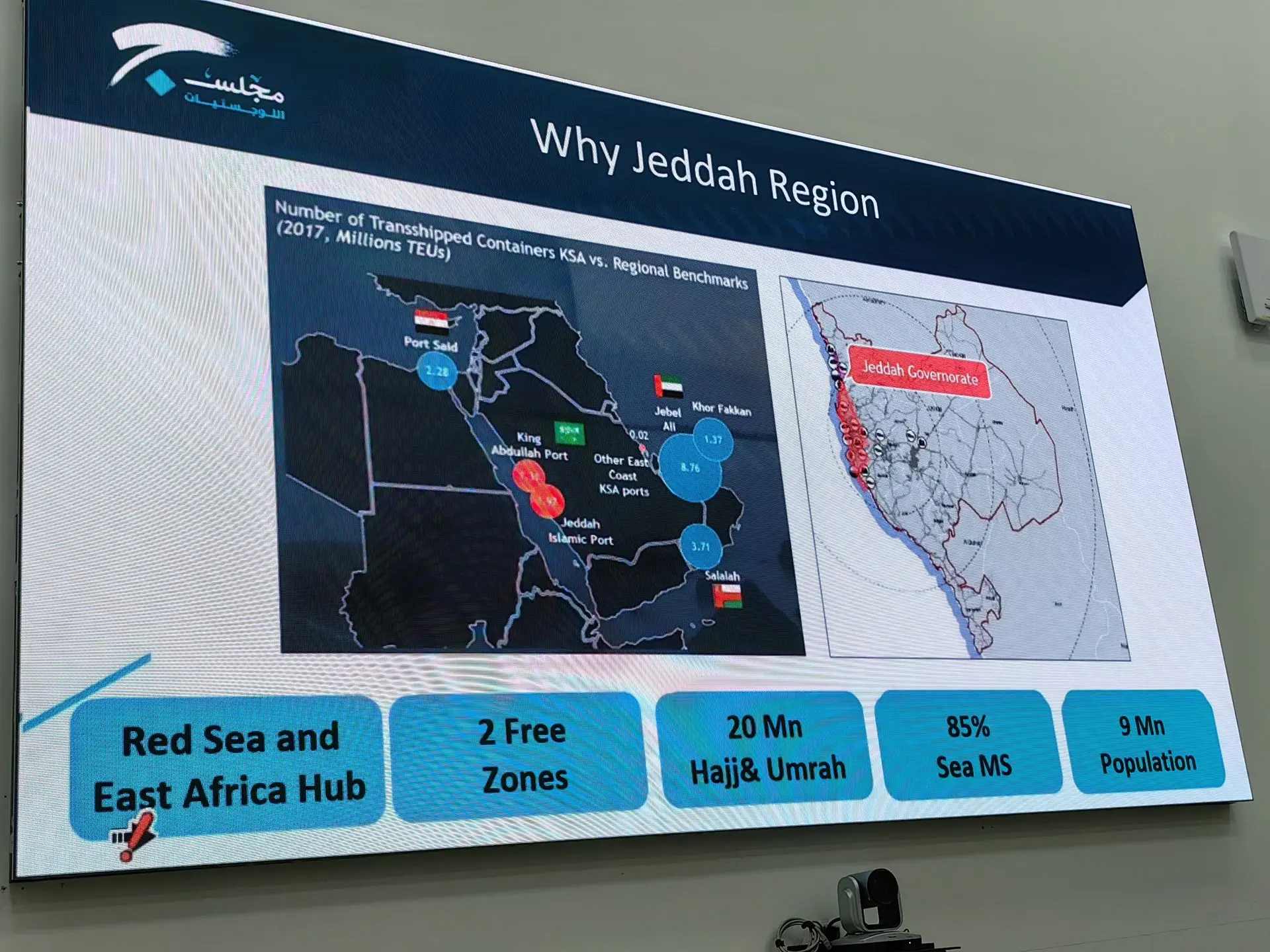

The logistics roundtable at Jeddah Chamber provided practical insights into doing business in Saudi Arabia. We discussed supply chain challenges, local partnership requirements, and the regulatory environment. These discussions were crucial for understanding how G&E Sales could structure potential partnerships in the Kingdom.

Jeddah Islamic Port: Trade Gateway

Our final visit was to Jeddah Islamic Port, one of the largest and most important ports on the Red Sea. As Saudi Arabia positions itself as a global logistics hub, understanding the port infrastructure and expansion plans was essential. The port handles massive volumes of construction materials for megaprojects across the Kingdom.

Expo 2030 Riyadh: A Game-Changing Opportunity

One topic that came up repeatedly during our visit was Expo 2030 Riyadh. Saudi Arabia won the bid with 119 out of 165 votes, supported by a budget of $7.8 billion. The Expo will run from October 2030 to March 2031 and is expected to transform Riyadh.

Economic Impact: During its development phases, the project is projected to contribute $64 billion to Saudi Arabia's GDP and generate around 171,000 direct and indirect jobs. Once operational, it will add $5.6 billion annually to the national economy.

Construction Opportunities: The Expo site covers 6 million square meters in North Riyadh, featuring 226 pavilions in a circular layout. Countries can build permanent pavilions, creating long-term legacy projects. For construction and sustainable building companies, this represents enormous opportunities in everything from infrastructure to green building technologies.

Market Opportunities for G&E Sales and Construct Green

Based on our observations and meetings, several opportunities stood out:

Sustainable Construction Materials: With 58.7 GW of planned renewable energy capacity generating multi-billion-dollar opportunities in solar, wind, and supporting infrastructure, there's strong demand for sustainable building solutions.

Green Building Technologies: Saudi Arabia is hosting the first carbon-negative World Expo and has committed to 50% renewable energy by 2030. Projects prioritize energy-efficient designs, solar integration, and environmental responsibility.

Training and Capacity Building: Saudization policies require companies to employ Saudi nationals. Special training programs in engineering and sustainable construction could help companies meet these requirements while building local capacity.

Renewable Energy Projects: The Kingdom's $235 billion renewable energy investment target by 2030 creates massive opportunities for companies specializing in renewable energy solutions and integration.

Expo 2030 Related Projects: From pavilion construction to infrastructure development, the Expo creates near-term opportunities for specialized contractors and sustainable building experts.

Understanding the Saudi Business Environment

Our visit also clarified important aspects of doing business in Saudi Arabia:

Localization Requirements: Companies must understand Saudization policies requiring specific percentages of Saudi nationals in their workforce. The consulting sector now requires 40% Saudi national employment.

Regional Headquarters Requirement: New guidelines effective from January 2024 restrict government contracting opportunities to companies with regional headquarters in Saudi Arabia. This is crucial for companies planning serious market entry.

Partnership Approach: Saudi business culture values long-term relationships and demonstrated commitment. Quick deals are rare - patience and relationship-building are essential.

Registration and Licensing: To participate in public tenders, including Expo 2030 opportunities, foreign companies must obtain commercial registration in Saudi Arabia.

Construction Sector Deep Dive

The numbers tell an impressive story. The sector is backed by Saudi Arabia's Public Investment Fund, which finances major giga-projects like NEOM ($500 billion), Red Sea Global ($23.6 billion), and Qiddiya ($9.8 billion).

Market Segmentation: The construction market encompasses residential, commercial, industrial, infrastructure (transportation), and energy and utility construction. Residential construction leads with 39.1% of expenditure in 2024, driven by rapid population growth and housing demand.

Technology Adoption: Prefabrication, BIM, and robotics are expanding at a 6.04% CAGR, highlighted by NEOM's $347 million automation program that cuts on-site labor by 80%. This technological advancement creates opportunities for companies offering modern construction solutions.

Private Investment Growth: Private capital is rising at a 5.72% CAGR as foreign developers can now fully own local entities, accelerate PPP models, and co-fund giga-projects following the February 2025 Investment Law.

Key Takeaways from Our Saudi Arabia Business Mission

Massive Scale: The scale of construction and infrastructure development in Saudi Arabia is unlike anything else globally. With over $1 trillion in planned investments, the opportunities are enormous for specialized companies.

Serious Commitment to Sustainability: This isn't greenwashing - Saudi Arabia is genuinely committed to sustainable development, carbon reduction, and renewable energy. The Construct Green concept resonates strongly here.

Long-term Market Potential: While the megaprojects create near-term opportunities, the real value is in long-term partnerships and presence in the market. Companies planning quick exits won't succeed here.

Professional Organization: The value of working through established local partners and experts cannot be overstated to enter the market successfully.

Strategic Timing: With Expo 2030 approaching and Vision 2030 projects ramping up, 2024-2030 represents a golden window for market entry in Saudi Arabia's construction sector.

Looking Ahead: G&E Sales in Saudi Arabia

This business delegation confirmed what we suspected: Saudi Arabia represents a significant opportunity for G&E Sales and Construct Green. The Kingdom's commitment to sustainable development, massive infrastructure investment, and focus on economic diversification align perfectly with our expertise.

We're now evaluating the best path forward - whether through local partnerships, establishing a regional presence, or participating in specific projects like Expo 2030. The relationships we built during this trip and the market intelligence we gathered will be invaluable as we develop our Saudi Arabia strategy.

For companies in sustainable construction, renewable energy, or infrastructure development, Saudi Arabia should be on your radar. The market is real, the investments are flowing, and the opportunities are substantial. The key is approaching it strategically, with patience, and with the right partners.

Whether you're in construction, environmental technology, logistics, tourism, renewable energy, or digital solutions, Saudi Arabia's Vision 2030 transformation is creating demand for international expertise and partnerships.

Let's discuss how your company can capitalize on the opportunities in Saudi Arabia. Contact G&E Sales today to schedule a consultation and discover how we can support your market entry and growth in the Kingdom.

Reach out at info@geglobalsales.com.

Saudi Arabien