On December 2nd, 2025, Global & Emerging Sales (G&E Sales) participated in the Bavarian-Polish Business Cocktail at IHK für München und Oberbayern—a strategic forum organized by AHK Polska focusing on economic cooperation between Bavaria and Lower Silesia. The event brought together government officials, research institutions, investors, and ambitious startup founders to explore one of Europe's most dynamic bilateral partnerships.

The Strategic Context: A Partnership Rewriting Trade Books

The numbers tell a compelling story: Germany exported around €94 billion worth of goods to Poland in 2024, with Poland emerging as Germany's fourth-largest export destination—surpassing China for the first time since 2008. This represents a remarkable shift in Germany's trade priorities and underscores Poland's growing economic significance.

Over the past six years, German exports to Poland have grown at an average annual rate of 7.8%, the fastest growth rate among Germany's top twenty trading partners. Meanwhile, Poland exported approximately €87.4 billion to Germany in 2024, maintaining strong bilateral trade with its western neighbor.

More than 6,000 German companies currently operate in Poland, employing over 400,000 people. Recent surveys indicate that 51% of German companies planning to relocate production to Central and Eastern Europe choose Poland as their primary destination, ahead of Romania and Ukraine.

High-Level Government Engagement

The Bavarian-Polish Business Cocktail brought together decision-makers, signaling the strategic importance both regions place on deepening their economic ties.

The event opened with addresses from three key figures:

- Prof. Klaus Josef Lutz (IHK München)

- Tobias Gotthardt (Bavarian State Ministry for Economic Affairs)

- Rafal Wolski (Polish Consul General in Munich)

All three emphasized the strategic priority of deepening bilateral economic ties, recognizing that the Bavaria-Poland corridor represents one of Europe's most promising growth opportunities.

Macroeconomic Analysis: Understanding the Opportunity

Urszula Kryńska from PKO Bank Polski delivered comprehensive insights on macroeconomic potentials for Poland and Bavaria, providing data-driven perspectives on trade flows, investment opportunities, and sector synergies between the regions.

Why Poland Attracts German Investment

According to recent KPMG surveys, 42% of German companies plan to invest in Central and Eastern Europe within the next year, with 56% intending to do so within five years. The factors driving this interest include:

Geographic and Logistical Advantages:

- Direct proximity to the German market

- Well-developed transportation infrastructure connecting to major European markets

- Access to Baltic seaports for international trade

- Strategic position in European supply chains

Economic Factors:

- Competitive labor costs compared to Western Europe

- Poland's GDP was projected to grow by 3.6% in 2025, according to the European Commission

- Stable economic environment with EU membership

- Strong currency and financial system

Human Capital:

- Highly qualified workforce with strong technical education

- Growing pool of engineering and IT talent

- Motivated employees with strong work ethic

- Improving English language proficiency across the workforce

Innovation Partnership Panel: Building the Future Together

The core discussion, moderated by Dr. Lars Gutheil (AHK Polska) and Christoph Angerbauer (IHK für München und Oberbayern), featured distinguished panelists representing both regions' innovation ecosystems:

- Michał Rado - Vice-Marshal of Lower Silesia

- Jakub Mazur - Vice Mayor of Wrocław

- Jarosław Bosy - Łukasiewicz Research Network

- Johann Feckl - Fraunhofer-Gesellschaft

- Dr. Andreas Glenz - PREVAC

Key Discussion Topics

The panel explored critical areas of cooperation:

Regional Innovation Ecosystems: How Bavaria's advanced manufacturing excellence combines with Lower Silesia's rapidly growing innovation infrastructure to create synergies that benefit both regions.

Research Collaboration Frameworks: Establishing formal partnerships between institutions like Fraunhofer-Gesellschaft and Łukasiewicz Research Network to accelerate technology transfer and joint research projects.

Technology Transfer Mechanisms: Creating pathways for innovations to move efficiently from research institutions to commercial applications, benefiting startups and established companies alike.

Concrete Partnership Opportunities: Identifying specific sectors and projects where Bavarian and Polish companies can collaborate on manufacturing, R&D, and market expansion.

Pre-Event Market Entry Briefing

Before the main forum, participating companies received practical guidance on entering and operating in the German and Polish markets:

Legal Frameworks and Compliance (Eversheds Sutherland): Understanding regulatory requirements, corporate structures, and compliance obligations in cross-border operations.

Financing Strategies for German Expansion (PKO Bank Polski): Exploring financing options, banking relationships, and financial instruments available for companies expanding into Germany.

State Support Programs (Invest in Bavaria): Learning about available grants, tax incentives, and support mechanisms for foreign companies investing in Bavaria.

Wrocław: Poland's Leading Innovation Hub

The Startup Ecosystem

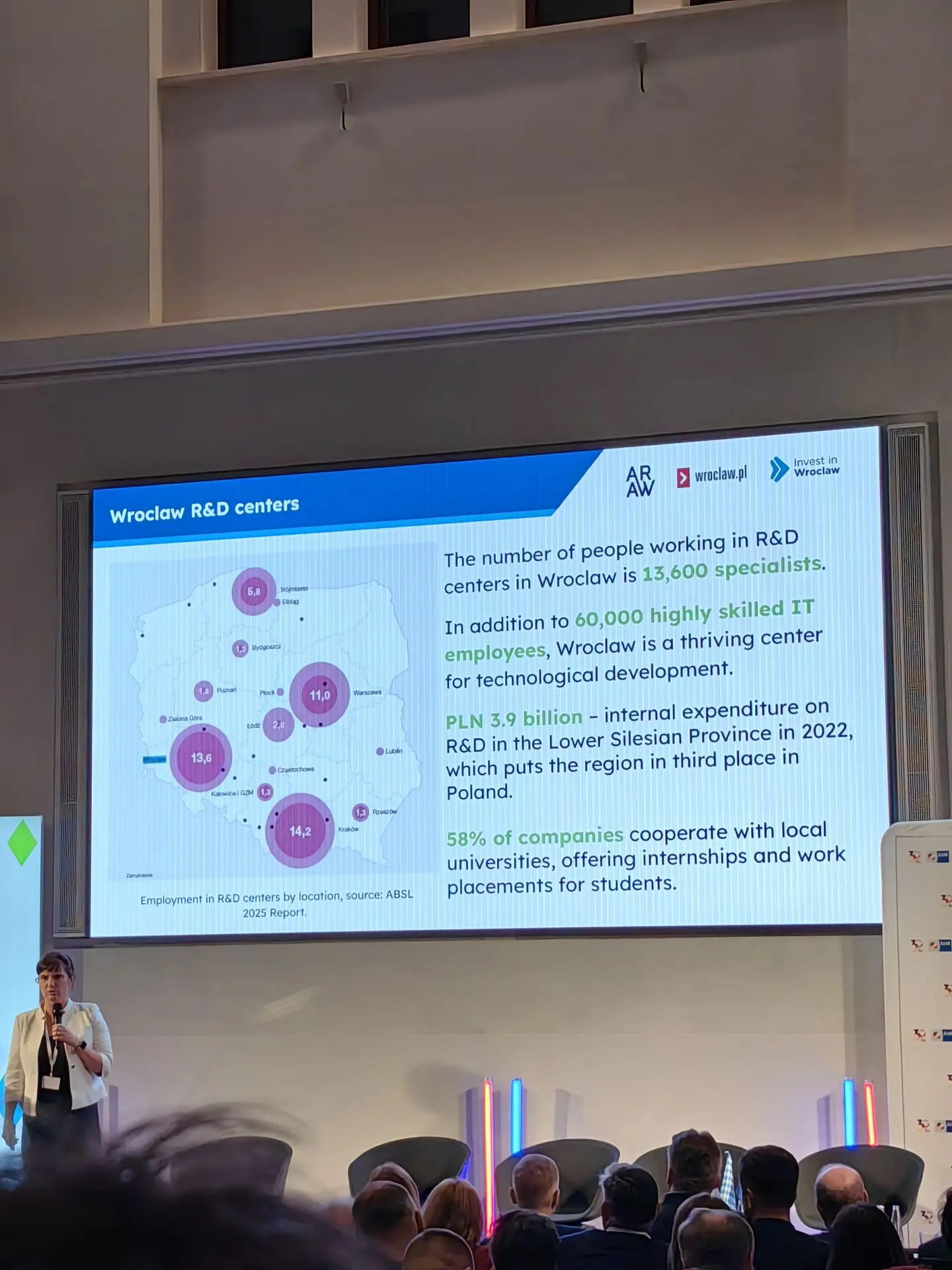

Magdalena Okulowska from the Development Agency of Wrocław Agglomeration moderated an impressive showcase of startups, demonstrating why Wrocław has emerged as Poland's premier innovation hub.

Since 2021, Wrocław and Lower Silesia have maintained top positions in Poland's startup rankings—ranking first in 2022 and 2023, and second in 2021, 2024, and 2025. This consistency proves the stability and maturity of the local ecosystem.

Currently, 23% of Polish startups choose Lower Silesia as their base for development, attracted by the region's supportive infrastructure, access to talent, and proximity to Western European markets.

Featured Startups at the Event

The showcase included four innovative companies representing the breadth of Wrocław's startup scene:

Gallio PRO - AI-powered video and photo anonymization technology, addressing critical privacy needs in an increasingly surveilled world.

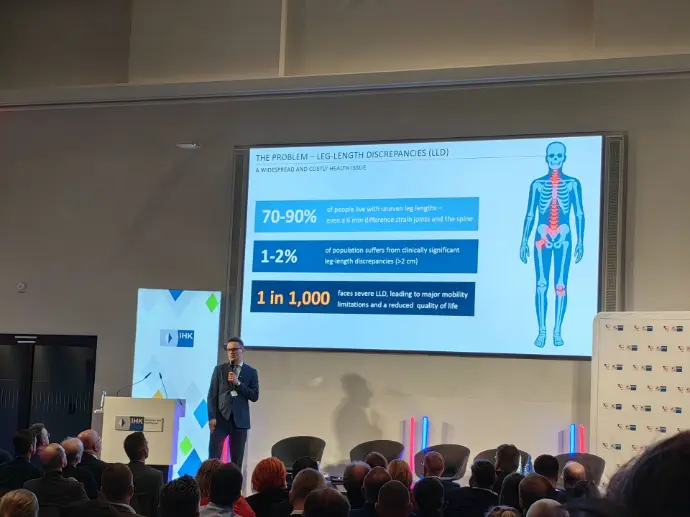

Orthoget - Developing innovative intramedullary long bone implants, advancing medical technology with Polish engineering expertise.

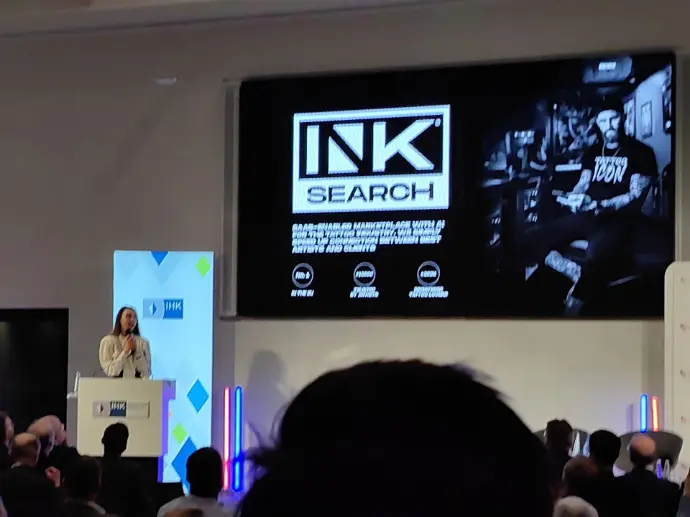

INKsearch.co - SaaS-enabled marketplace with AI for the tattoo industry, digitizing and modernizing a traditionally offline sector.

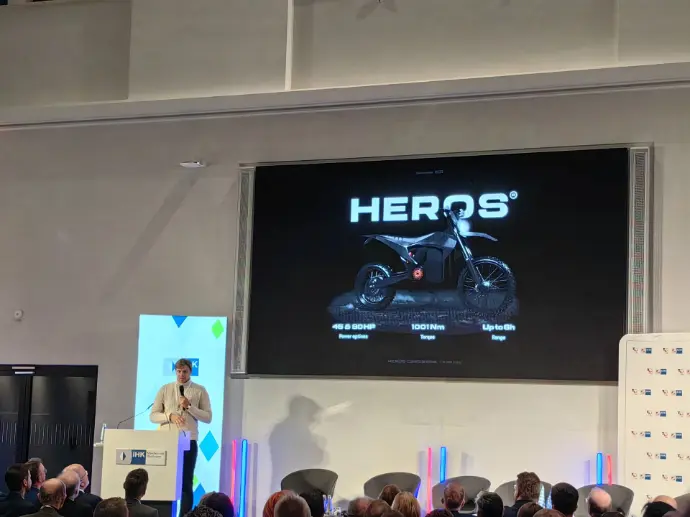

HEROS Motorcycles - Creating innovative electric enduro motorcycles, combining Polish engineering with sustainable transportation solutions.

Poland's Broader Startup Revolution

The companies showcased at the forum represent just a fraction of Poland's thriving innovation ecosystem. In 2024, Polish startups raised a total of €2.3 billion in venture capital funding, representing a 30% increase compared to the previous year.

In the first quarter of 2025 alone, Polish technology companies raised €442 million—representing 78% of the investment value from the same period in 2024. This acceleration demonstrates growing investor confidence in Polish innovation.

Poland's Position in Central and Eastern Europe

The total value of the startup ecosystem in Central and Eastern Europe reached a record €243 billion at the end of the first quarter of 2025, with Poland capturing the largest share. Of the more than 275 companies classified as Scaleups in the CEE region—startups that have achieved rapid growth and secured funding exceeding €15 million—the majority operate in Poland.

Poland's startup ecosystem has grown by over 150% since 2020, making it one of the fastest-growing markets in Central and Eastern Europe. The country now boasts 13 unicorns (companies valued at over $1 billion), with several more companies approaching this milestone.

Key Investment Trends

The Polish startup ecosystem shows particular strength in several key sectors:

Fintech: Warsaw has emerged as a fintech and enterprise software capital, with numerous companies developing innovative financial solutions for both consumer and business markets.

Artificial Intelligence: Kraków has become known for AI research and development, serving as an R&D base for global tech giants while nurturing homegrown AI startups.

Deep Tech: Wrocław is attracting deep-tech and engineering talent, boosted by Intel's planned semiconductor facility and a strong technical university system.

Defense and Security: Poland is strengthening its position in dual-use technologies, particularly in defense and security sectors, with defense spending exceeding 4% of GDP.

The Bavaria-Lower Silesia Partnership: A Perfect Combination

The strategic partnership between Bavaria and Lower Silesia offers compelling complementary strengths:

Bavaria's Strengths:

- Advanced manufacturing capabilities and process expertise

- World-class research institutions (Fraunhofer, Max Planck)

- Strong automotive and engineering sectors

- Established global supply chains

- Deep capital markets and investment resources

Lower Silesia's Strengths:

- Highly skilled and cost-competitive workforce

- Rapidly growing startup ecosystem with entrepreneurial energy

- Strategic location for Eastern European market access

- Modern infrastructure with continued investment

- Government support for foreign investment and innovation

Practical Cooperation Opportunities

The combination creates concrete opportunities for collaboration:

Manufacturing Partnerships: Bavarian companies can leverage Polish manufacturing capabilities for more cost-effective production while maintaining quality standards, with several major German manufacturers already operating successful facilities in Poland.

Joint R&D Projects: Research institutions from both regions can collaborate on cutting-edge projects, combining Bavaria's research excellence with Poland's engineering talent and lower operational costs.

Startup-Corporate Collaboration: Polish startups can access Bavarian corporate partners and customers, while Bavarian companies can leverage Polish innovation and agility.

Supply Chain Integration: Approximately 5% of the value of Polish exports is German value added, meaning goods from Germany are often processed in Poland and then re-exported, demonstrating deep integration of the two economies.

Market Access: Polish companies gain easier access to Western European markets through Bavarian partnerships, while Bavarian companies use Poland as a gateway to Central and Eastern European markets.

Looking Forward: The Future of Bavaria-Poland Cooperation

As the evening concluded with dinner and networking discussions, several themes emerged about the future of this strategic partnership:

Deepening Integration: The economic relationship between Bavaria and Poland will continue to deepen, with more companies establishing cross-border operations and joint ventures.

Innovation Collaboration: Research institutions and universities will increasingly collaborate on joint projects, particularly in emerging technologies like artificial intelligence, renewable energy, and advanced manufacturing.

Startup Ecosystem Connections: More Bavarian investors will look to Polish startups for investment opportunities, while Polish startups will increasingly target the German market for expansion.

Infrastructure Investment: Continued investment in transportation and digital infrastructure will further reduce barriers between the regions and facilitate closer cooperation.

Talent Mobility: As both regions face talent shortages in key technical fields, increased cross-border talent mobility will become essential, with professionals moving more freely between Bavaria and Poland.

Conclusion: A Partnership for the Future

The Bavarian-Polish Business Cocktail demonstrated that the partnership between Bavaria and Lower Silesia represents far more than a typical trade relationship. It's a strategic alliance between two of Europe's most dynamic innovation regions, each bringing complementary strengths to create opportunities that neither could achieve alone.

For companies looking to expand in either direction, the message is clear: this is one of Europe's most promising corridors for growth, innovation, and partnership. As economic headwinds challenge other traditional relationships, the Bavaria-Poland partnership stands out as a model of successful regional cooperation built on mutual strengths, shared values, and genuine opportunity.

The event at IHK München was not just a celebration of what has been achieved, but a launching pad for the next phase of this strategic partnership—one that promises to reshape the economic landscape of Central Europe in the years to come.

Willing to Expand into Bavaria or Poland?

Reach out to Global & Emerging Sales today to discuss how we can support your expansion strategy into Bavaria or Poland. Let's turn the potential of this strategic corridor into tangible business success for your company. Write to info@geglobalsales.com.

Bayerisch Poln